INFINITY TURBINE SALES | DESIGN | DEVELOPMENT | ANALYSIS CONSULTING

TEL: +1-608-238-6001 (Chicago Time Zone ) Email: greg@infinityturbine.com

Supercritical CO2 Turbine Generator The Alternative to the Gas Turbine Generators for Data Centers and Mining Operations More Info

The most overlooked technology niche is energy. Fill the vacuum with innovation in AI Data Center energy production.

|

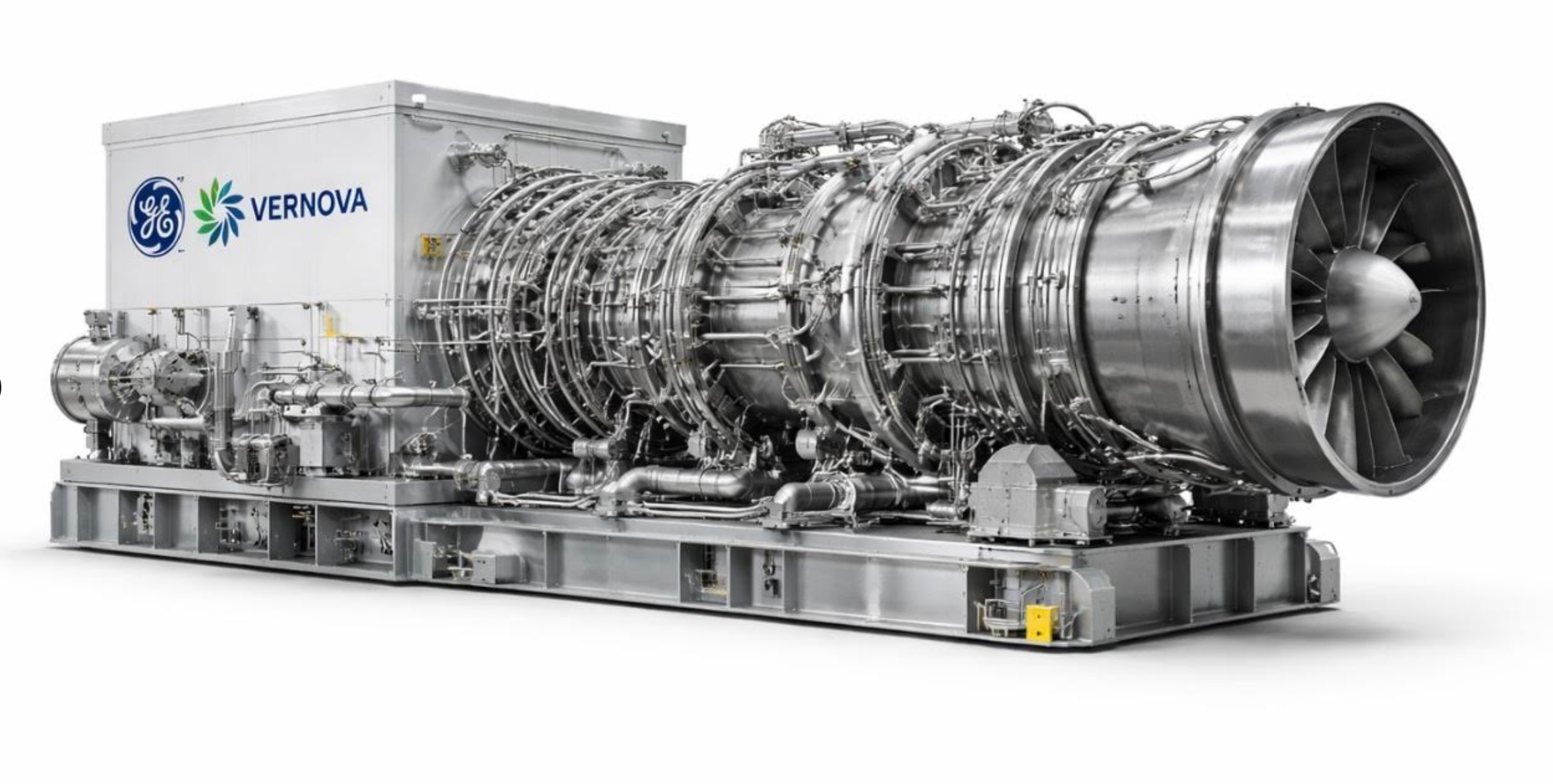

The AI infrastructure market has changed the power procurement playbook AI infrastructure is turning turbine capacity into a scarce commodity. GE Vernova’s gas turbine backlog is tightening enough that buyers are paying nonrefundable deposits years in advance—sometimes before final pricing—to secure delivery slots. Here’s how the pre-order model works, why it’s happening now, and what it means for data center developers and investors.Hyperscale data centers are scaling faster than grid interconnects, transformers, and firm generation can be delivered. The result is a new procurement behavior: buyers are treating power equipment capacity the way they treat land or chip supply—something you reserve early or you don’t get it on your schedule.GE Vernova sits at the center of this shift because it manufactures gas turbines (including aeroderivative packages) and the broader electrification equipment needed to connect new generation to the load. Utility and industry reporting has explicitly tied GE Vernova’s growing orders to data centers. ([Utility Dive][1])What pre-order strategy means in turbinesIn today’s gas turbine market, the product is increasingly a production slot, not just the machine.A clear example is a sales reservation agreement for a GE Vernova 7HA.02 turbine that required a nonrefundable deposit paid now for a 2030 delivery—with final pricing not necessarily locked at the time of reservation. ([Barron's][2])Financial media has described this phenomenon bluntly: data center customers are willing to pay upfront to secure future turbine production slots. ([Yahoo Finance][3])This mirrors what you see in constrained industrial supply chains: OEMs shift from quote → PO → build to reservation → deposit → later conversion to final contract.Why data centers are paying upfront even when the grid existsData center buyers are paying deposits early for three reasons:1. Backlog and long-cycle manufacturing capacityGE Vernova has indicated a ramp to around 20 GW of annual gas turbine output capacity (mid-2026 timeframe) while demand continues to accelerate. ([Utility Dive][4])2. AI demand is becoming an order driver, not just a narrativeGE Vernova has reported that hyperscale data centers are generating meaningful orders within its electrification and grid equipment lines, reinforcing that the demand signal is real across the power stack. ([Utility Dive][1])3. Project finance and schedule risk have flippedIf your data halls are ready before firm power arrives, you can lose millions per day in stranded capex and delayed revenue. In that context, a nonrefundable deposit can be rational insurance—especially if it locks schedule certainty.Evidence of direct data-center turbine demandGE Vernova has publicly announced large data-center-focused turbine package deals—most notably an agreement to deliver 29 LM2500XPRESS aeroderivative gas turbine packages to Crusoe for AI data centers, described as providing flexibility and rapid power delivery at scale. ([GE Vernova][5])This is the kind of equipment profile data center developers favor when they need:fast deployment,modularity,grid-parallel or islanded operation, anda repeatable power block for phased campuses.Why the reserve first, negotiate later model existsFrom GE Vernova’s perspective, upfront deposits do three things:Validate demand (reducing the risk of building capacity for speculative projects)Fund working capital for long-lead components and supplier commitmentsAllocate scarce production slots to the most committed buyersFrom the buyer’s perspective, the deposit buys:a place in the build queue,schedule confidence for commissioning, anda hedge against later scarcity pricing.This is why some coverage has framed the market as a pre-booking environment with nonrefundable deposits years ahead of delivery. ([Barron's][2])The strategic tradeoffs for hyperscalers and AI infrastructure developersIf you’re evaluating a GE Vernova-style turbine pre-order for data center power, the decision is less about is gas generation good? and more about risk allocation:BenefitsLocks schedule when turbine capacity is constrainedProtects data-hall go-live datesStrengthens negotiating leverage with EPCs and utilities (credible power plan)RisksCapital at risk (nonrefundable deposits)Potential mismatch if load plan or site strategy changesTechnology/permitting changes over a multi-year horizonBuyer may reserve capacity before interconnect, gas lateral, or emissions pathway is fully de-riskedA related public debate is whether this petrotech buildout shifts cost and commodity-price volatility onto end users and ratepayers; critiques have argued AI-driven gas buildouts can socialize risk. ([Financial Times][6])What to watch next (practical indicators)For operators and investors tracking GE Vernova in AI infrastructure, the key signals are:Reservation backlog depth (how far out capacity is effectively spoken for) ([Barron's][2])Deposit / prepayment behavior (how much cash is being pulled forward) ([Barron's][2])Aero-derivative package volume tied to data centers (repeatable modular deployments) ([GE Vernova][5])Electrification bottlenecks (switchgear/transformers) that can delay commissioning even if turbines are secured ([Utility Dive][1])Bottom lineGE Vernova’s role in the AI infrastructure market is increasingly defined by scarcity economics: buyers are paying upfront to reserve gas turbine production slots years in advance because power delivery timelines now determine data center revenue timelines. The pre-order with deposit model is becoming a standard tactic for hyperscalers and AI infrastructure developers that can’t afford schedule uncertainty. ([Barron's][2])If you want, I can turn this into a one-page investment memo (bullets + key risks), or a hyperscaler procurement checklist for negotiating reservation agreements (deposit terms, conversion triggers, cancellation rights, performance guarantees, and LDs).[1]: https://www.utilitydive.com/news/ge-vernova-bullish-on-electrical-infrastructure-as-turbine-backlog-grows/803631/ GE Vernova bullish on electrical infrastructure as turbine ...[2]: https://www.barrons.com/articles/ge-vernova-is-getting-cash-today-for-deliveries-in-2030-e6a567d1 GE Vernova Stock Hits New High. It's Getting Cash Today for Deliveries in 2030.[3]: https://finance.yahoo.com/news/heres-why-ge-vernova-stock-220757859.html Here's Why GE Vernova Stock Popped Higher Today (Hint[4]: https://www.utilitydive.com/news/ge-vernova-gas-turbine-orders-offshore-wind-earnings/810974/ GE Vernova Q4 gas turbine orders surge 74%[5]: https://www.gevernova.com/news/press-releases/ge-vernova-crusoe-announce-major-29-unit-aeroderivative-gas-turbine-deliver-ai-data-centers GE Vernova and Crusoe announce major 29-unit ...[6]: https://www.ft.com/content/d983ed37-c8cb-4d1e-aea9-5a4453f58b62 Letter: How US households subsidise the AI data centre boom |

|

GE Vernova Gas Turbine Reservation Strategy for Hyperscale AI Data Centers Executive SummaryThe rapid expansion of AI infrastructure has transformed power generation equipment from a commodity purchase into a capacity-constrained strategic asset. GE Vernova is experiencing strong demand for gas turbines and electrification systems, with hyperscale customers increasingly placing nonrefundable deposits years in advance to secure manufacturing slots.For hyperscalers with 50–300+ MW campus roadmaps, turbine reservation agreements are becoming a tool for schedule control, not just equipment procurement.Investment ThesisPower delivery timing now drives data center revenue timing.Securing turbine production capacity through early deposits can:• Protect time-to-market for AI compute clusters• Reduce risk of stranded data hall capex• Strengthen financing confidence• Improve negotiating leverage with EPCs and utilities• The key strategic shift is from buy equipment when ready to reserve production capacity early to de-risk infrastructure sequencing.Market ContextAI-driven data center growth is accelerating firm power demand.Turbine production capacity is limited and long-cycle.Reservation agreements with upfront deposits are being used to lock 2028–2030 delivery windows.Hyperscale buyers are treating generation capacity like land or chip supply—scarce and pre-allocatable.Strategic Benefits to Hyperscaler1. Schedule CertaintySecures manufacturing slots in a constrained turbine market.2. Capital Efficiency ProtectionPrevents multi-hundred-million-dollar data halls from waiting on power equipment.3. Competitive AdvantageEarly reservation can create a power moat in constrained regions.4. Financing and Investor SignalingDemonstrates credible long-term power strategy for AI campus expansion.Financial Considerations• Deposit Structure• Typically nonrefundable reservation payments• May precede final commercial terms• Converts to full equipment contract later• CAPEX Implication• Gas turbine plant CAPEX (100 MW scale) often materially higher than reciprocating engine alternatives• Larger EPC complexity and longer deployment cycle• OPEX Considerations• Fuel exposure (natural gas pricing)• Maintenance contracts• Potential efficiency benefits at high load factorsRisk Assessment1. Capital at RiskNonrefundable deposits can become stranded if:Site strategy changesInterconnect delays extend beyond expectationPermitting changes2. Technology Lock-InMulti-year reservations reduce flexibility to pivot to alternative architectures (e.g., reciprocating engines, hybrid microgrids).3. Market VolatilityGas price fluctuations and policy shifts could alter operating economics.4. Execution RiskTurbine reservation does not eliminate:Transformer bottlenecksSwitchgear delaysGas lateral construction timelinesComparative Consideration: Reciprocating Engine FleetsFor 100 MW scale deployments with <18-month power deadlines, modular natural gas reciprocating engine fleets may offer:• Faster deployment• Lower initial slot dependency• Higher operational flexibility post-grid• Reduced upfront reservation exposure• Turbines are stronger when:• Building permanent utility-scale generation• Long-term baseload is certain• Schedule allows 24–48+ month horizonDecision Framework for HyperscalerAsk:1. Is power delivery gating compute revenue?2. Is grid interconnect timeline uncertain beyond 18 months?3. Is campus growth locked beyond 5 years?4. Can deposit capital be justified as schedule insurance?If yes to 3 or more, turbine reservation becomes strategically rational.Recommended Action Plan1. Conduct parallel evaluation:Turbine reservation agreementReciprocating modular plant alternative2. Negotiate:Deposit conversion triggersDelivery guaranteesLiquidated damagesSlot transferability clauses3. Align turbine reservation with:Gas supply contractInterconnect approvalCampus phase rolloutBottom Line• The GE Vernova turbine pre-order strategy represents a shift in infrastructure economics: hyperscalers are reserving production capacity to control schedule risk in the AI era. • The move can be justified when time-to-power equals time-to-revenue—but it must be structured carefully to avoid stranded capital and inflexibility. |

|

|

| CONTACT TEL: +1-608-238-6001 (Chicago Time Zone USA) Email: greg@infinityturbine.com | AMP | PDF |