PDF Publication Title:

Text from PDF Page: 044

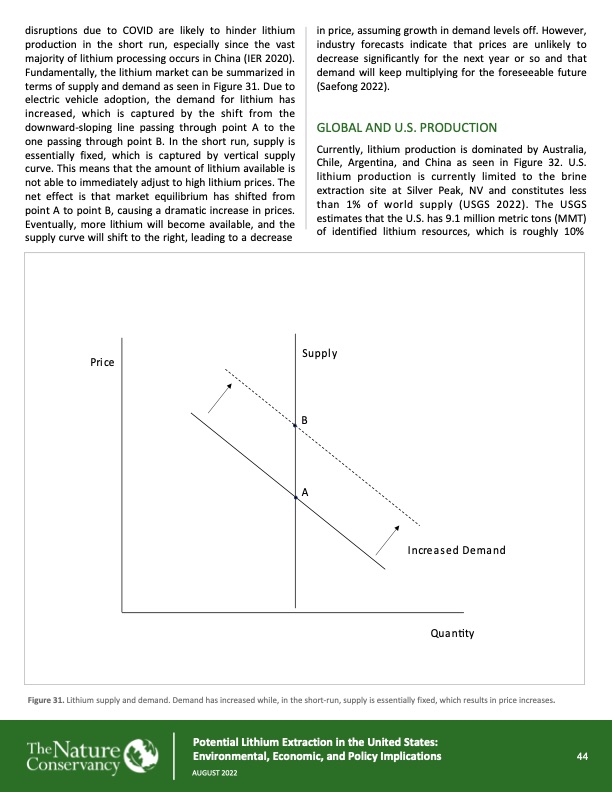

disruptions due to COVID are likely to hinder lithium production in the short run, especially since the vast majority of lithium processing occurs in China (IER 2020). Fundamentally, the lithium market can be summarized in terms of supply and demand as seen in Figure 31. Due to electric vehicle adoption, the demand for lithium has increased, which is captured by the shift from the downward-sloping line passing through point A to the one passing through point B. In the short run, supply is essentially fixed, which is captured by vertical supply curve. This means that the amount of lithium available is not able to immediately adjust to high lithium prices. The net effect is that market equilibrium has shifted from point A to point B, causing a dramatic increase in prices. Eventually, more lithium will become available, and the supply curve will shift to the right, leading to a decrease in price, assuming growth in demand levels off. However, industry forecasts indicate that prices are unlikely to decrease significantly for the next year or so and that demand will keep multiplying for the foreseeable future (Saefong 2022). GLOBAL AND U.S. PRODUCTION Currently, lithium production is dominated by Australia, Chile, Argentina, and China as seen in Figure 32. U.S. lithium production is currently limited to the brine extraction site at Silver Peak, NV and constitutes less than 1% of world supply (USGS 2022). The USGS estimates that the U.S. has 9.1 million metric tons (MMT) of identified lithium resources, which is roughly 10% Pri ce Suppl y B A Figure 31. Lithium supply and demand. Demand has increased while, in the short-run, supply is essentially fixed, which results in price increases. Increased Demand Quan�ty Potential Lithium Extraction in the United States: Environmental, Economic, and Policy Implications 44 AUGUST 2022PDF Image | Potential Lithium Extraction in the United States

PDF Search Title:

Potential Lithium Extraction in the United StatesOriginal File Name Searched:

Lithium_Report_FINAL.pdfDIY PDF Search: Google It | Yahoo | Bing

Product and Development Focus for Infinity Turbine

ORC Waste Heat Turbine and ORC System Build Plans: All turbine plans are $10,000 each. This allows you to build a system and then consider licensing for production after you have completed and tested a unit.Redox Flow Battery Technology: With the advent of the new USA tax credits for producing and selling batteries ($35/kW) we are focussing on a simple flow battery using shipping containers as the modular electrolyte storage units with tax credits up to $140,000 per system. Our main focus is on the salt battery. This battery can be used for both thermal and electrical storage applications. We call it the Cogeneration Battery or Cogen Battery. One project is converting salt (brine) based water conditioners to simultaneously produce power. In addition, there are many opportunities to extract Lithium from brine (salt lakes, groundwater, and producer water).Salt water or brine are huge sources for lithium. Most of the worlds lithium is acquired from a brine source. It's even in seawater in a low concentration. Brine is also a byproduct of huge powerplants, which can now use that as an electrolyte and a huge flow battery (which allows storage at the source).We welcome any business and equipment inquiries, as well as licensing our turbines for manufacturing.| CONTACT TEL: 608-238-6001 Email: greg@infinityturbine.com | RSS | AMP |